Winter 2023 Market Update | Smith-Dobrowky Team

Janaury 18, 2023

Geoff’s Synopsis

The story of the year across all local markets is that of uncanny interest rate hikes, flattening activity and falling prices with the Bank of Canada raising rates a total of 4% in 2022 from .25% to 4.25%.

Current thinking is expecting a further .25% increase forecasted for January 25, 2023 and then a leveling for some time from there. What does this mean for the real estate market? Well little price support and the influx of listings from distressed sellers has been slow to materialize yet we saw an uptick in inventory in December with further slumping sales. So this may be a perfect storm approaching for more downward pressure in the marketplace. Yes jobs numbers were up last month but these are a lagging indicator of a falling economy and everywhere I turn I hear the word recession and lower financials and the forward indicators of economic downturn such as inverted yield curves all suggest tough times ahead in 2023.

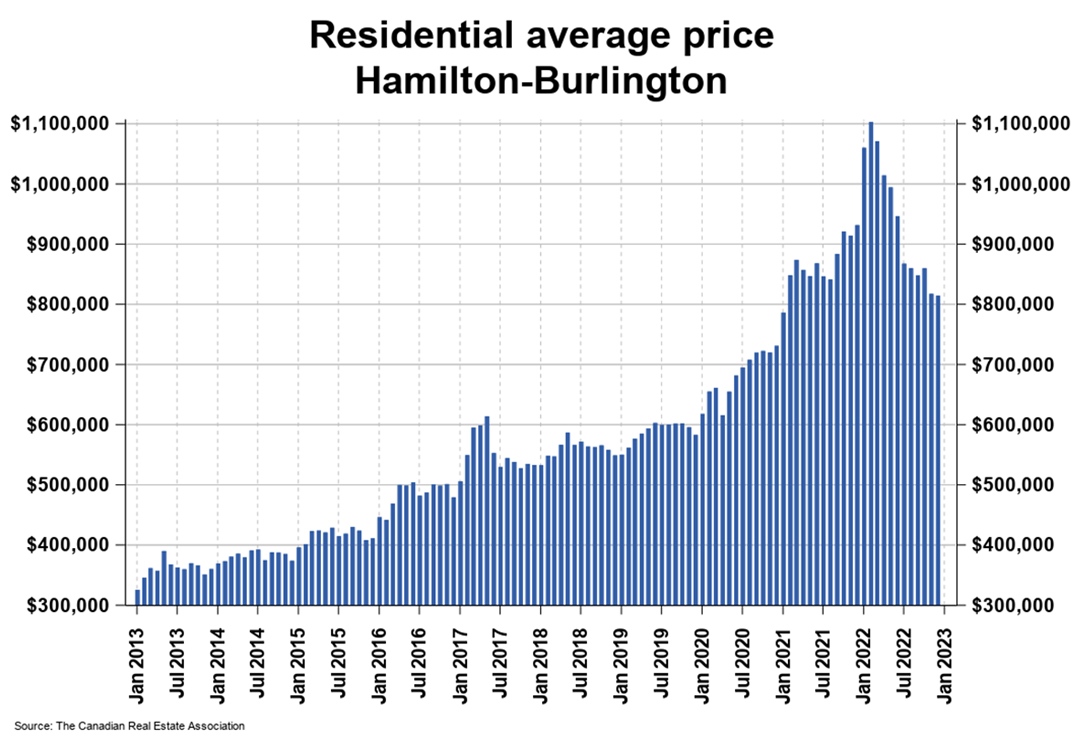

Hamilton/Burlington Market Update

The year 2022 marked a year of adjustment as sales activity dramatically eased by 30% over the near record highs of 2021. The pullback in sales has allowed inventory gains across all price ranges. The easing of sales and rising supply has shifted the market from early in the year from an extreme sellers’ market into more balanced territory. This shift has popped the bubble and deflated house prices from their peak in February 2022.

Surprisingly after the initial pullback prices have been somewhat stable since September and are still holding close to early 2021 levels. As per the chart below the peak average price occurred in February 2022 at $1.1M and dropped to just over $800k by December 2022. From peak to trough this looks to be approximately a 27% drop yet year over year only a 14% drop that is how crazy the market was early 2022. How much more is there to go? I am of the opinion that we still have a way to go if we draw a line of progression from 2013 onward as per the chart ignoring the craziness of the low interest rate over supply of money of the Covid era. That line suggests a bit more tightening in the market pricing to get us back on that line since 2013 suggesting an average price of between $700-750k which with all the negative economic forces abound seems very realistic this coming year. If we carry this trend line to the early 2000’s then this line becomes flatter still as we saw higher than historical growth rates from 2013 onward to this past year. Hopefully in 2024 we will see some normalcy then re-enter the housing market and a lower but more steady growth rate will resume and can reasonably be expected as wages catch up with inflation and the shortage of housing for the populace continues to factor in.

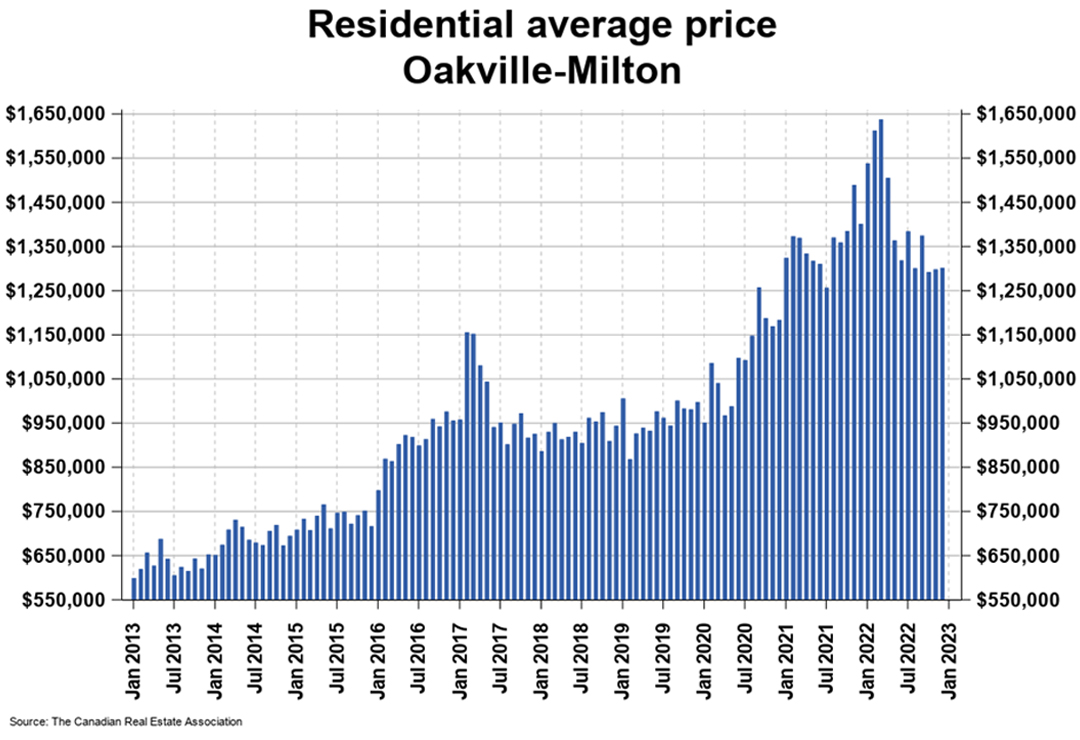

Oakville/Milton Market Update

The number of homes sold through the MLS of Oakville/Milton totalled 168 units in December 2022 which was a 18% decline vs December 2021. Home sales were 16.7% below the 5 year average and 22.4% below the 10 year average for the month. Sales on an annual basis were down 32.1% year over year.

New listings are holding steady and have been supportive in raising listing inventories as sales levels have slowed continuing the trend of a more balanced market. At this time we hope to see interest rates flatten out and pricing to stabilize in the short term which will hopefully bring more buyers back into the market place. (I personally feel the full brunt of the interest rate hikes are yet to hit the marketplace)

The HPI composite benchmark price was $1.28M in December 2022 a decrease of 11.6% compared to December 2021. Active residential listings numbered 409 more than double the level from a year ago surging 258%. The average price of homes sold in December 2022 was $1,301,916, down by 7.1% from December 2021. The more comprehensive annual average price was $1,435,472, an increase of 6.1% from all of 2021.

Months of inventory numbered 2.4 at the end of December 2022, up from the 0.6 months recorded at the end of December 2021 and above the long-run average of 2.2 months for this time of year. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

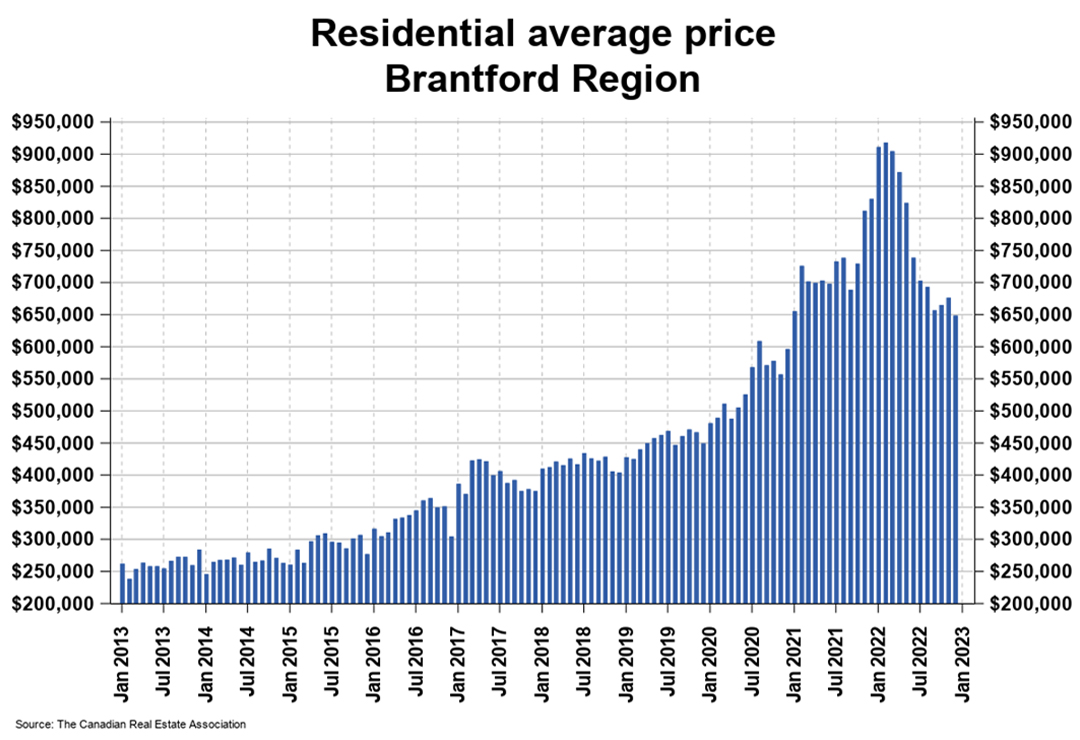

Brantford Market Update

Brantford saw a decrease in sales of 26.6% in December 2022 vs December 2021. On an annual basis home sales totalled 2057 units in 2022 down 25.4% from 2021. The overall MLS Home Price Index (HPI) which tracks price adjustments more accurately than is possible using average or median pricing metric performances saw a 12.2% reduction vs. December 2021. The average price of homes sold in December 2022 was $658,513 a substantial decline of 21.94% vs December 2021. Listings were up 15.3% vs. a year ago with 113 new residential listings in December 2022. Active listings were 42% above the five-year average and 9% above the 10-year average for the month of December.

Months of inventory numbered 3.1 at the end of December 2022, up from the 0.4 months recorded at the end of December 2021 and above the long-run average of 2.4 months for this time of year. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

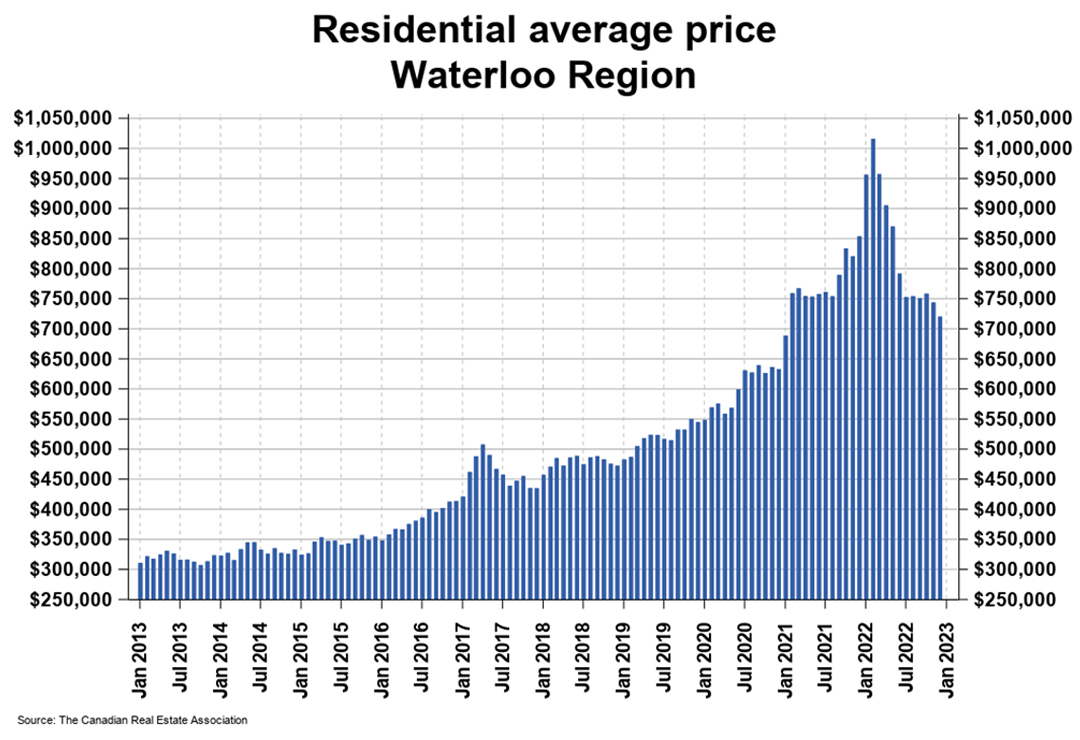

Waterloo Market Update

There were 7,770 homes sold through the Multiple Listing Service® (MLS®) System of the Waterloo Region Association of REALTORS® (WRAR) in 2022, a decrease of 24.8 per cent compared to 2021. On a historical basis, 2022 performed lower than previous years, with annual sales down 12.4 per cent compared to the previous 5-year average, and 8.2 per cent below the previous 10-year average.

On a monthly basis, there were 280 homes sold in December, a decrease of 38.7 per cent compared to December 2021, and 32.3 per cent below the previous 5-year average for the month.

“The number of homes sold in December was lower than any single month in well over a decade, marking an end to a turbulent year for home sales in Waterloo Region,” says Megan Bell, President of WRAR.

In December, the average sale price for all residential properties in Waterloo Region was $720,596. This represents a 15.5 per cent decrease compared to December 2021 and a 2.1 per cent decrease compared to November 2022.

The average price of a detached home was $825,450. This represents a 17.6 per cent decrease from December 2021 and a decrease of 1.7 per cent compared to November 2022.

Sign up for our

Real Estate Newsletter

We LOVE Referrals!

Help Us Help Your Family and Friends. Helping YOU is what we DO!

Thinking of selling? Act now and don't dwell!

Thinking about buying a home or an investment property?

Let's talk strategy for the upcoming year!

Geoff Smith & Katrinna Smith-Dobrowsky

Sales Representatives

Halton Heritage Realty

Contact Details

Feel free to contact us anytime. We would be happy to discuss your unique needs.

Phone

![]() Geoff's Cell: (905) 512-0301

Geoff's Cell: (905) 512-0301

![]() Katrinna's Cell: (905) 630-9579

Katrinna's Cell: (905) 630-9579

Committed To Success. Committed To You

Established 2006

Established 2006  Proven System to Sell Your House

Proven System to Sell Your House  Investment Property Advisors

Investment Property Advisors

Country Properties & Vacant Land

Country Properties & Vacant Land  Downsizing & Up-sizing Advisors

Downsizing & Up-sizing Advisors

Professional Lawyers and Stagers

Professional Lawyers and Stagers  Financing Specialists

Financing Specialists  First Time Home Buyers

First Time Home Buyers

Multi Award Winning Agents

Multi Award Winning Agents

YourRealPro.com

REAL ESTATE MARKETS SERVED